Are Tax Cuts Just Not Cutting It? Improving the Efficiency of the Corporate Tax System - Austaxpolicy: The Tax and Transfer Policy Blog

Federal Inland Revenue Service NG on Twitter: "31st JULY, 2018 is the DUE DATE for filing the following Tax Returns: For companies having 31st January, 2018 as Accounting Year End; 1)Companies Income

You may be liable to tax on your previously exempted investment income effective from 2 January 2022 - Tax & Business Matters - Nigeria

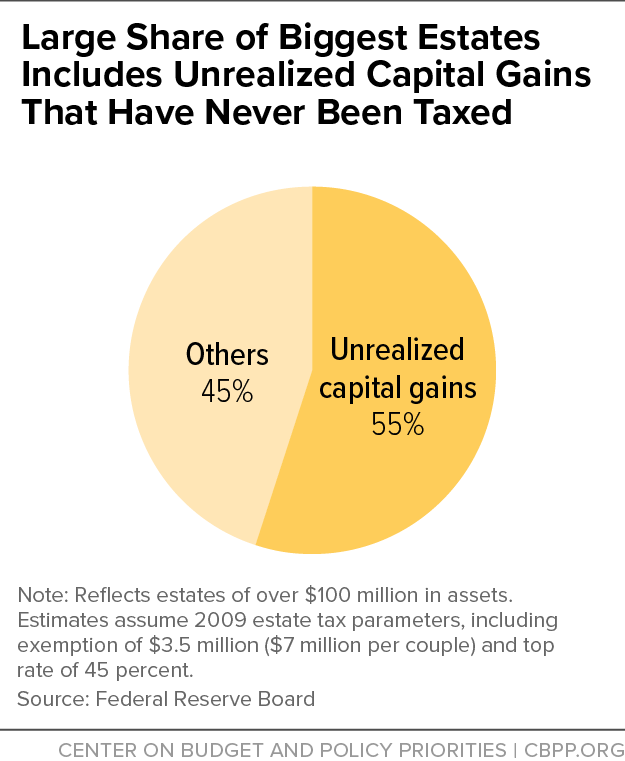

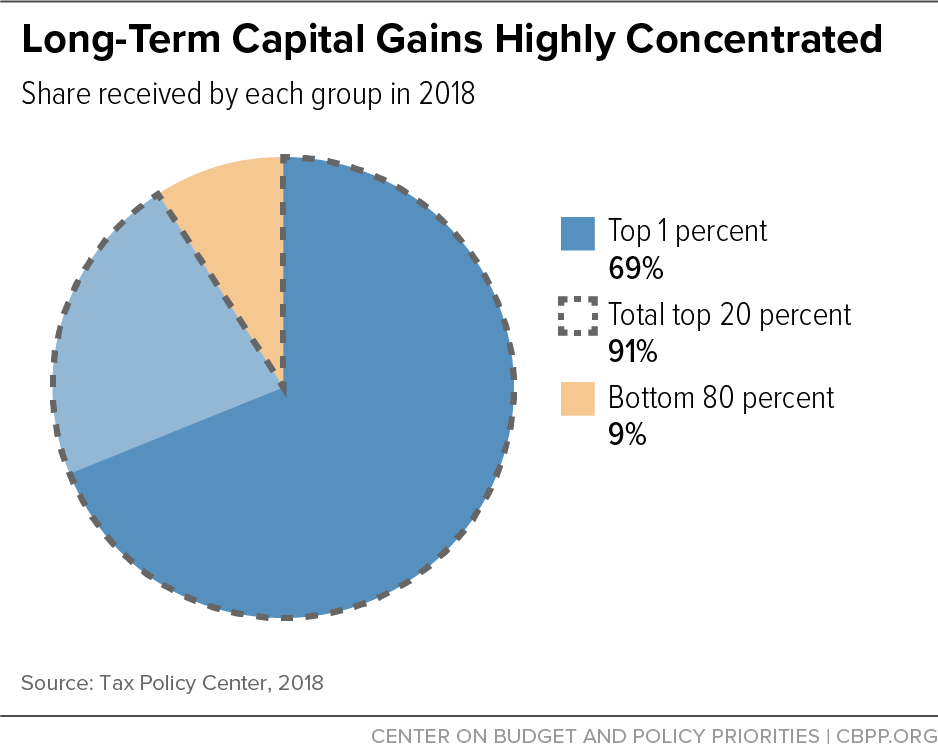

Substantial Income of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks | Center on Budget and Policy Priorities

Federal Inland Revenue Service NG on Twitter: "31st MARCH, 2018 IS THE DUE DATE OF FILING THE FOLLOWING TAX RETURNS: I. Personal Income Tax (PIT) for 2018. II. For companies having 30th

Substantial Income of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks | Center on Budget and Policy Priorities

Substantial Income of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks | Center on Budget and Policy Priorities

Estimating the Corporate Income Tax Gap in: Technical Notes and Manuals Volume 2018 Issue 002 (2018)