![Should I Refinance My Mortgage? [Infographic] | Mortgage interest rates, Paying off mortgage faster, Mortgage infographic Should I Refinance My Mortgage? [Infographic] | Mortgage interest rates, Paying off mortgage faster, Mortgage infographic](https://i.pinimg.com/736x/d0/e8/19/d0e819f4f8101e96a9764784b977e859--refinance-calculator-refinance-mortgage.jpg)

Should I Refinance My Mortgage? [Infographic] | Mortgage interest rates, Paying off mortgage faster, Mortgage infographic

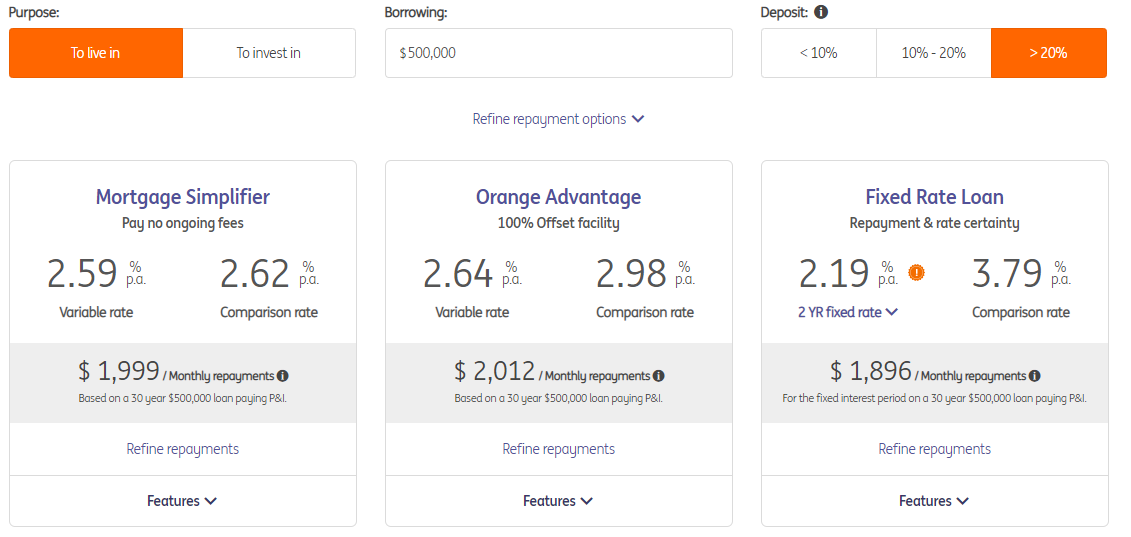

VIP Finance Australia Pty Ltd - Ing Direct Orange Advantage Variable Rate 3.74% (Comparison rate 4.06%), Mortgage Simplifier Variable Rate 3.89% (Comparison rate 3.92%) for Owner Occupied, Principal & Interest loans of

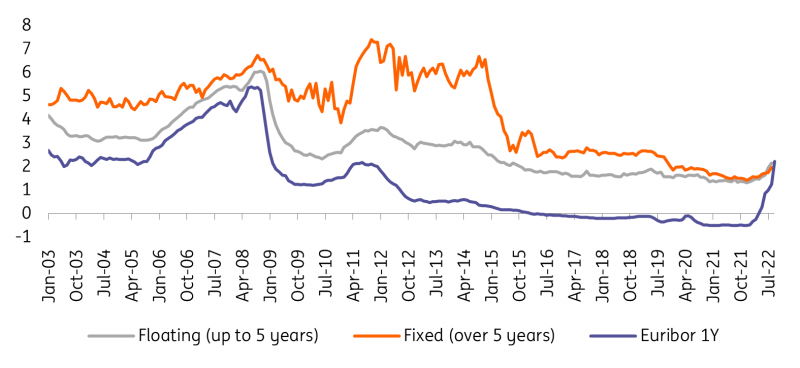

Housing Prices and Prepayments for Fixed-Rate Mortgage-Backed Securities | The Journal of Fixed Income