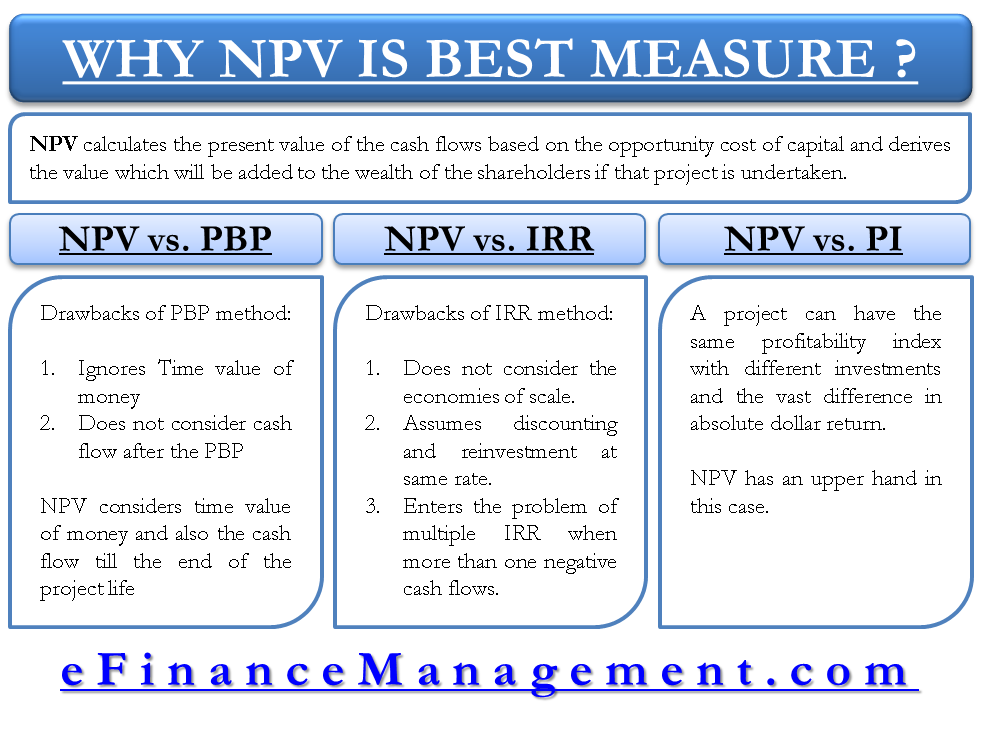

A Framework for Interpreting Realized Economic Value From Data Science Projects | by Neeraja Sarda | Medium

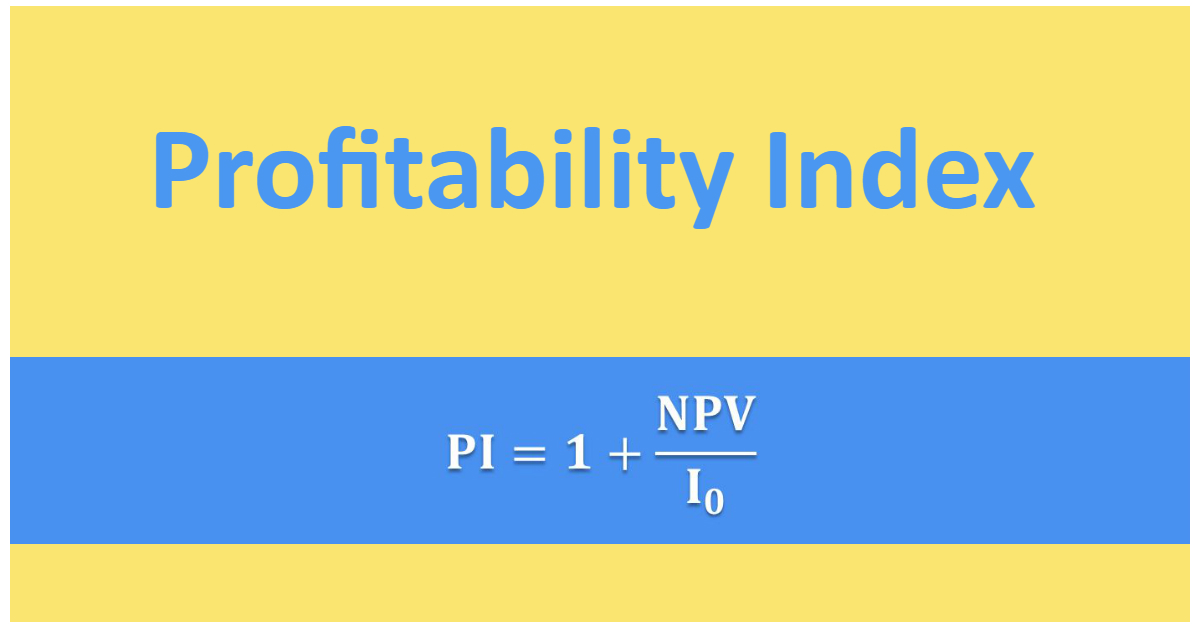

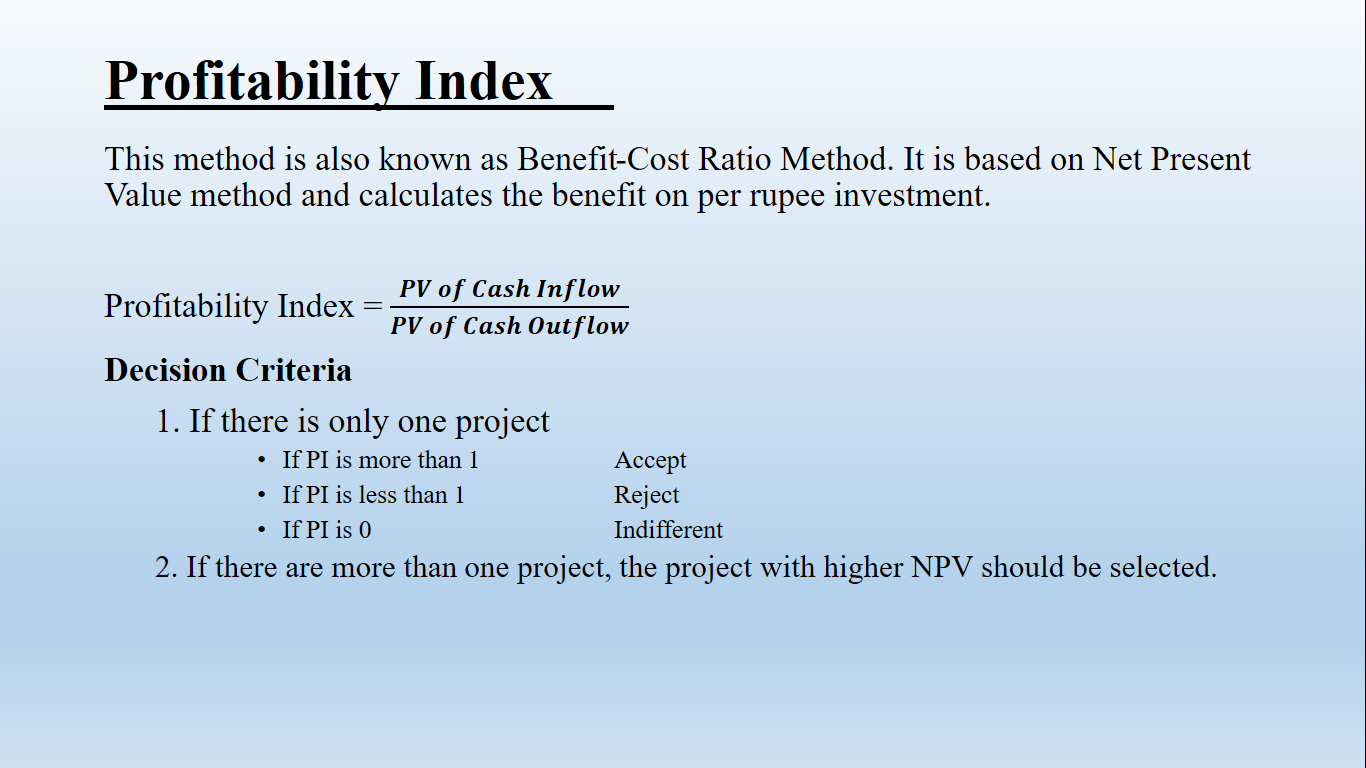

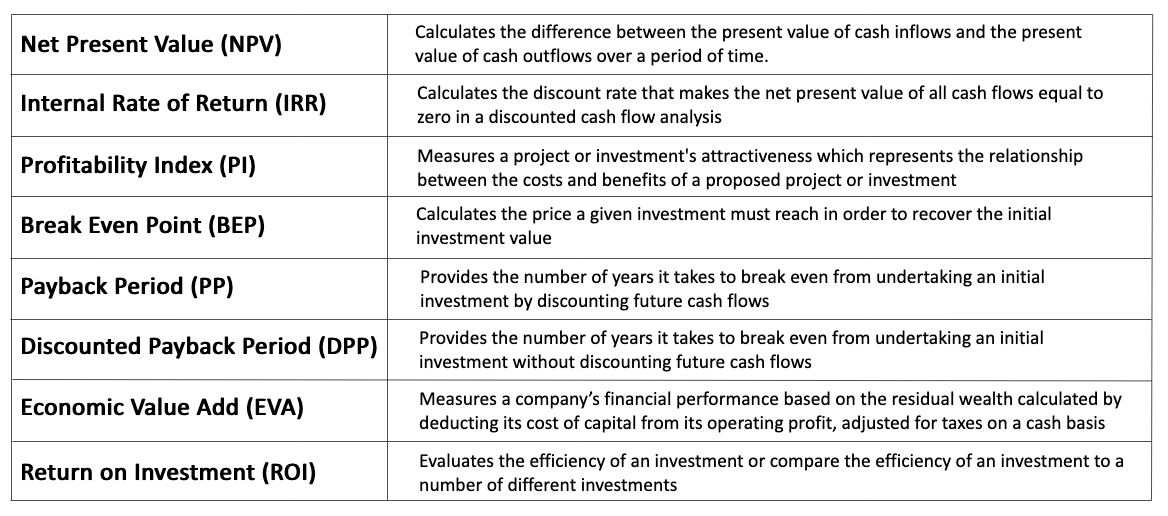

Profitability Index is defined as the present value of future cash flows divided by the initial investment. #CFA #Finance #investment | By Professional Finance Studies (PFS) | Facebook

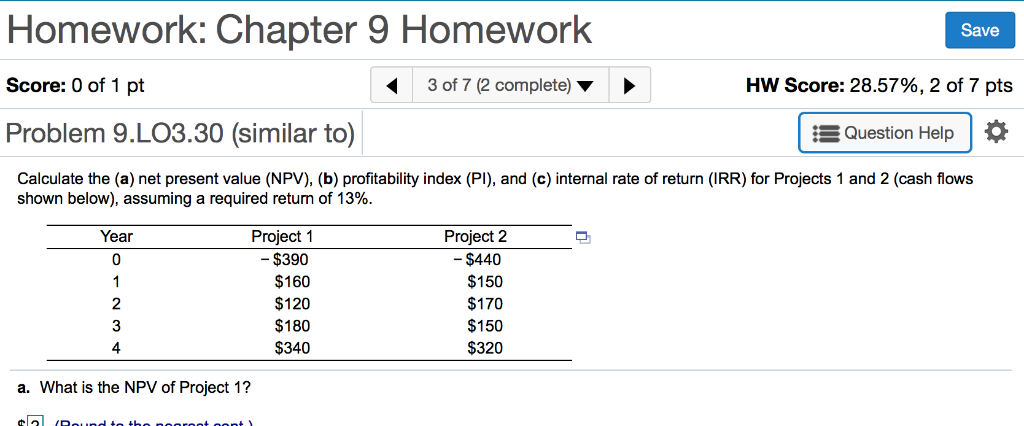

Indicators of the effectiveness of projects. Profitability index (PI) - planning in Budget-Plan Express

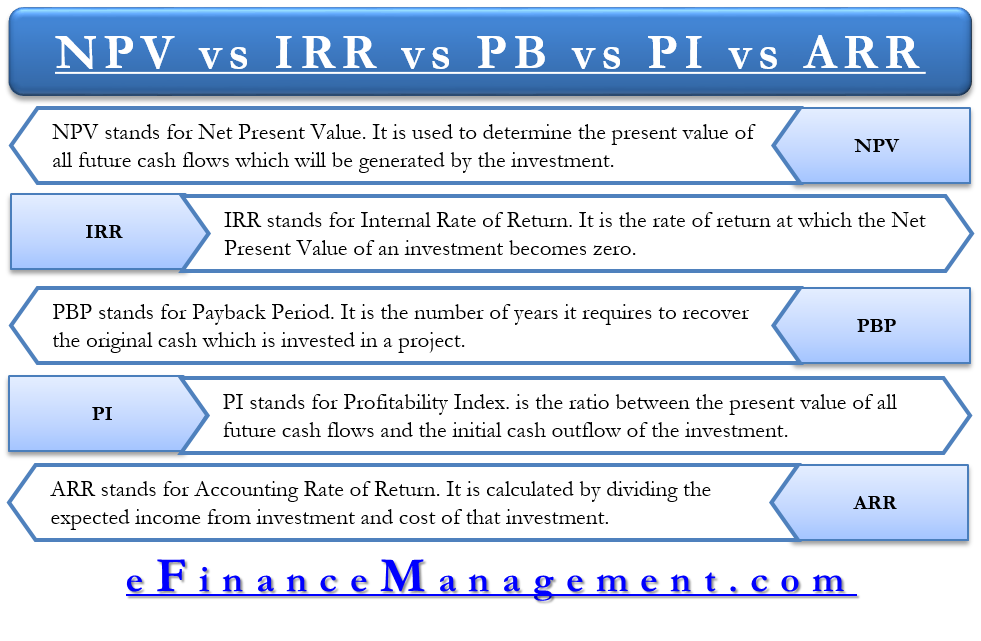

Trends of (a) Net Present Value (NPV), b) Pay-back period (PBP), c)... | Download Scientific Diagram