The Difference Between a Tenant Improvement, Build-Out, and a Leasehold Improvement - Hurd Construction

INTERNAL REVENUE SERVICE NATIONAL OFFICE TECHNICAL ADVICE MEMORANDUM March 15, 2010 Third Party Communication: None Date of Co

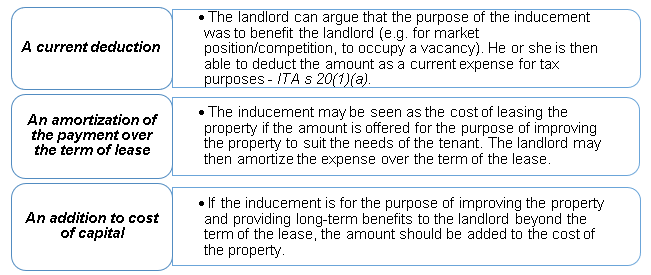

Tax treatment of tenant improvements: Who should make them — landlord or tenant? | Our Insights | Plante Moran