CLOSED FORM PRICING FORMULAS FOR DISCRETELY SAMPLED GENERALIZED VARIANCE SWAPS - Zheng - 2014 - Mathematical Finance - Wiley Online Library

Closed-form pricing formulas for variance swaps in the Heston model with stochastic long-run mean of variance | SpringerLink

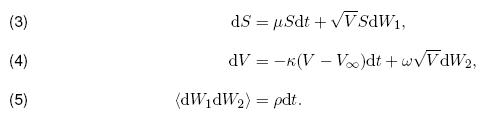

Pricing Options on Realized Variance in Heston Model with Jumps in Returns and Volatility 1 Introduction

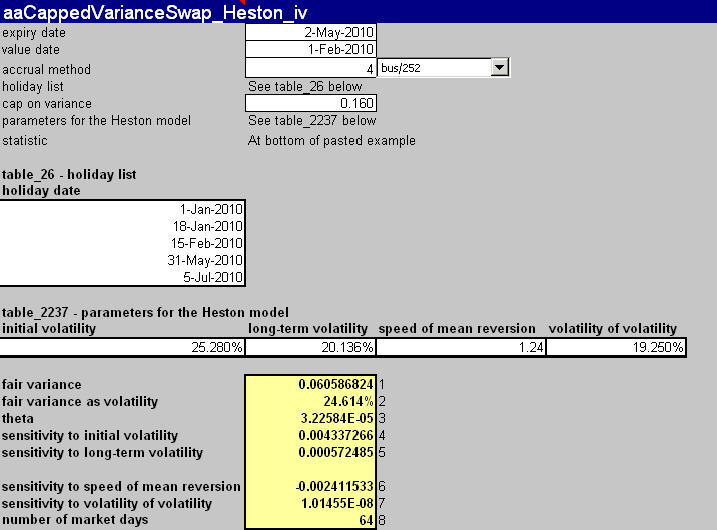

Pricing Discretely Sampled Variance Swaps with Cap/Floor Under Heston Stochastic Volatility Model - Stoykov - 2021 - Wilmott - Wiley Online Library

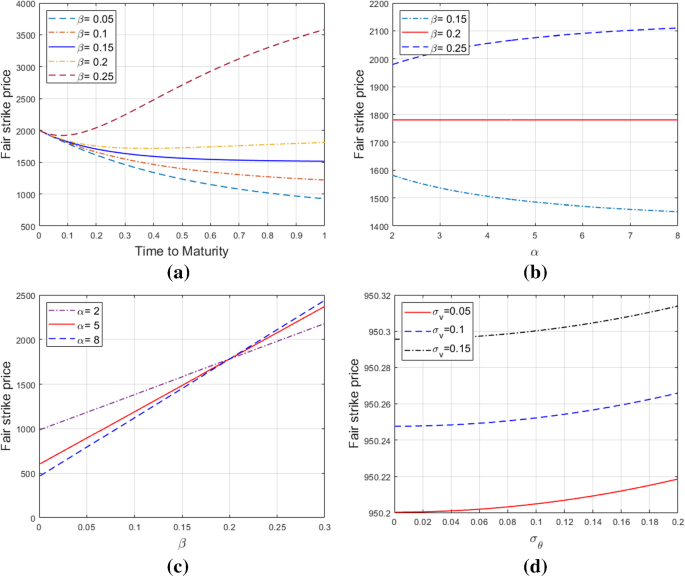

Mathematics | Free Full-Text | A Closed-Form Pricing Formula for Log-Return Variance Swaps under Stochastic Volatility and Stochastic Interest Rate

The CTMC–Heston model: calibration and exotic option pricing with SWIFT - Journal of Computational Finance

Mathematics | Free Full-Text | A Closed-Form Pricing Formula for Log-Return Variance Swaps under Stochastic Volatility and Stochastic Interest Rate

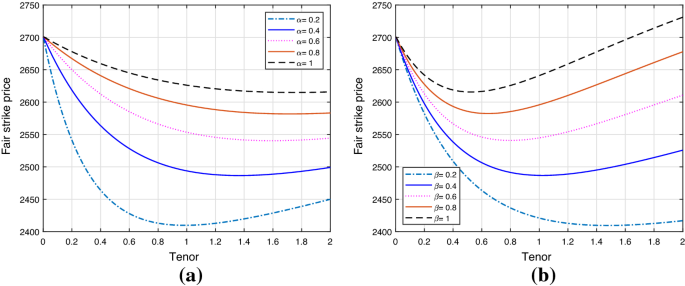

A Closed Form Solution for Pricing Variance Swaps Under the Rescaled Double Heston Model | SpringerLink

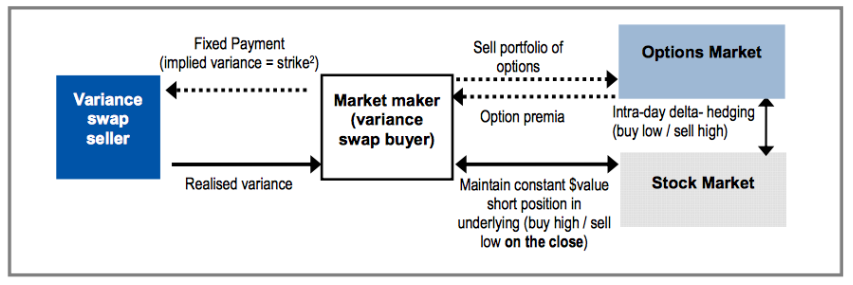

Fourier transform algorithms for pricing and hedging discretely sampled exotic variance products and volatility derivatives unde

Pricing Options on Realized Variance in Heston Model with Jumps in Returns and Volatility 1 Introduction

The CTMC–Heston model: calibration and exotic option pricing with SWIFT - Journal of Computational Finance

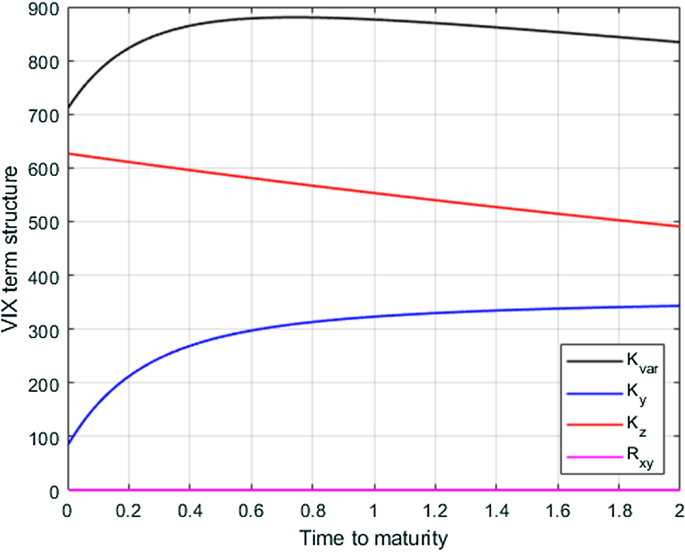

CLOSED FORM PRICING FORMULAS FOR DISCRETELY SAMPLED GENERALIZED VARIANCE SWAPS - Zheng - 2014 - Mathematical Finance - Wiley Online Library

A Closed Form Solution for Pricing Variance Swaps Under the Rescaled Double Heston Model | SpringerLink

Pricing Options on Realized Variance in Heston Model with Jumps in Returns and Volatility 1 Introduction

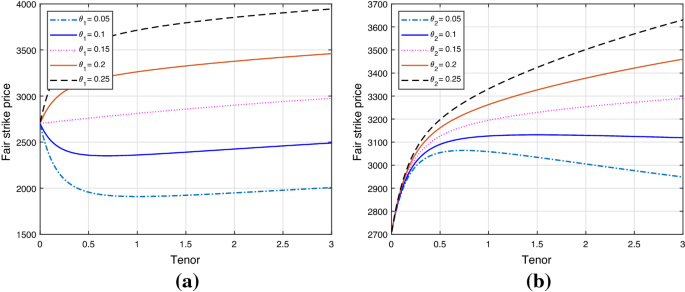

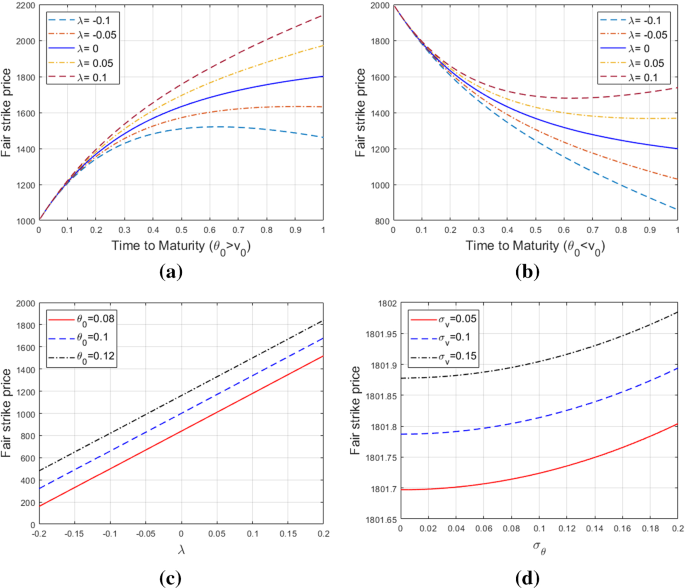

Closed-form pricing formulas for variance swaps in the Heston model with stochastic long-run mean of variance | SpringerLink