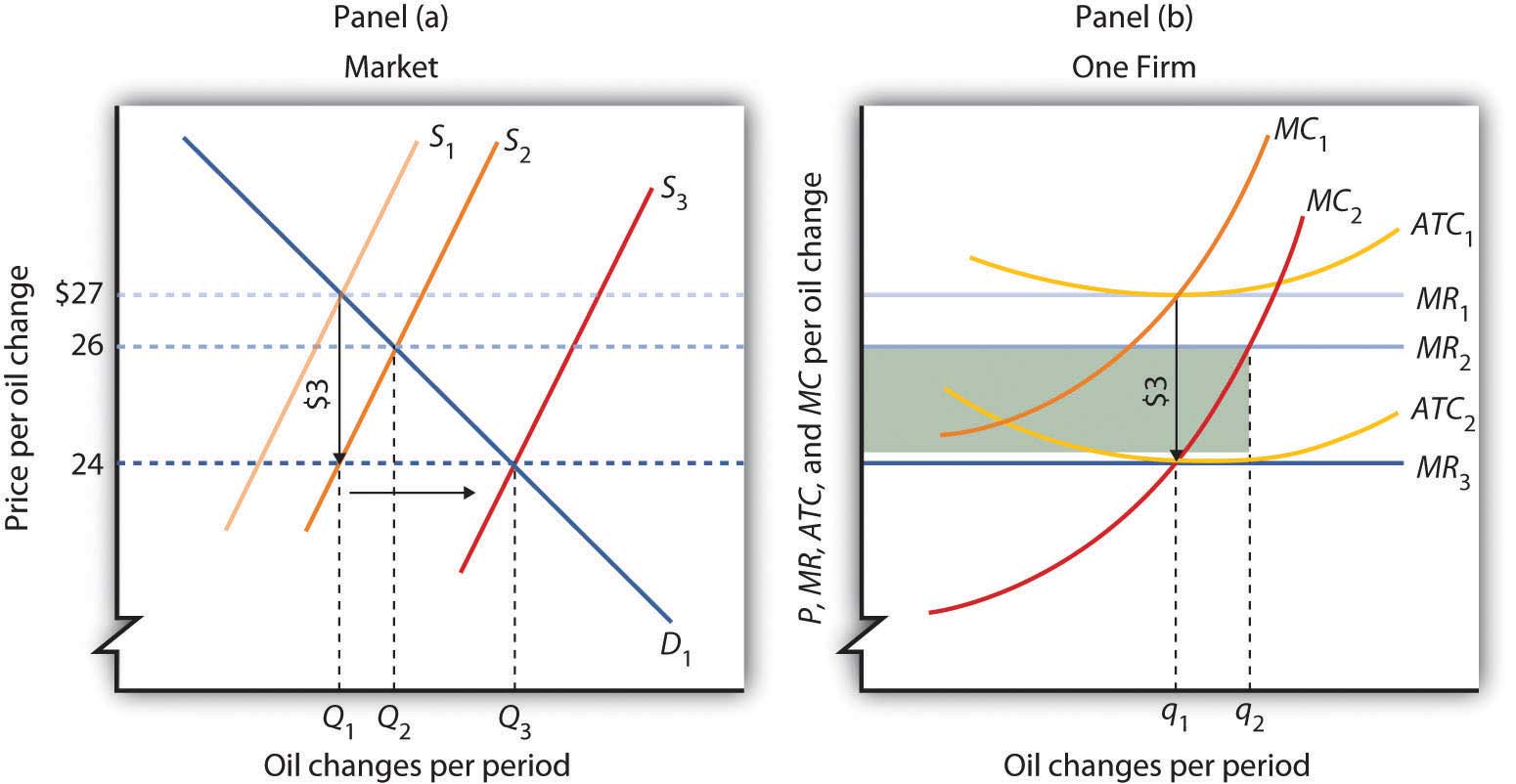

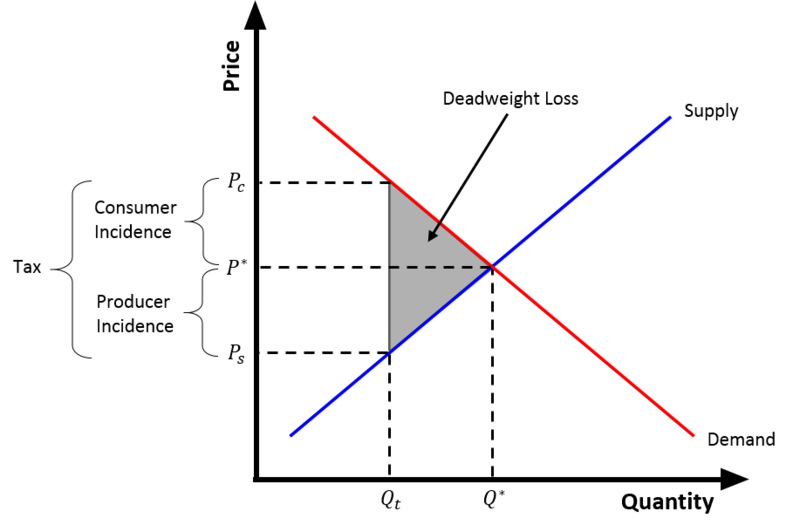

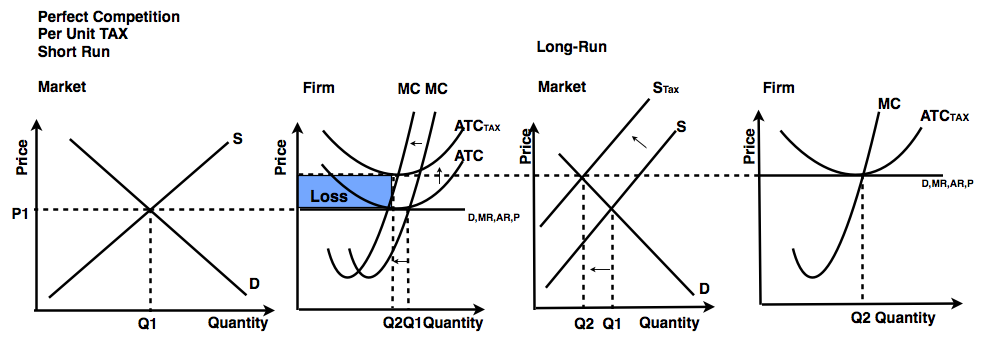

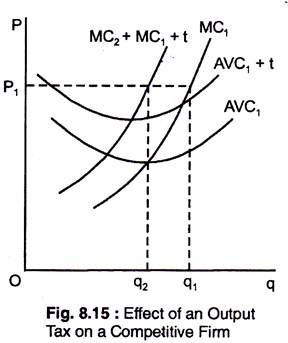

Show the short-run impact of a $2 per unit excise tax imposed on firms in a competitive industry. (Assume the industry is in equilibrium before the tax was imposed.) How would the

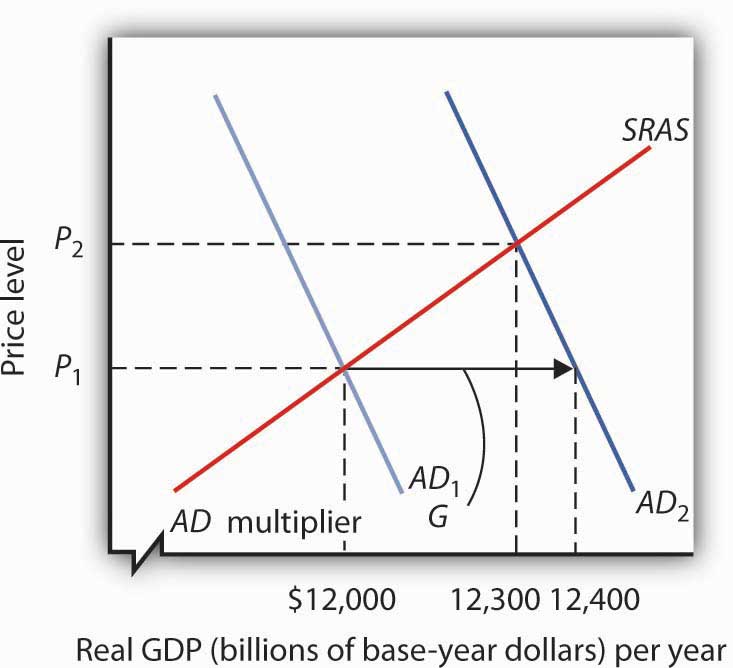

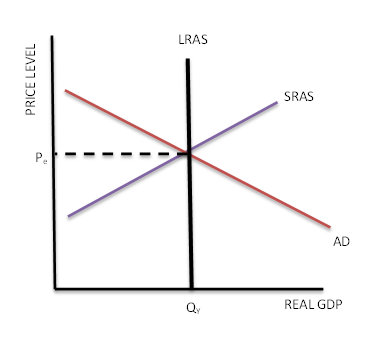

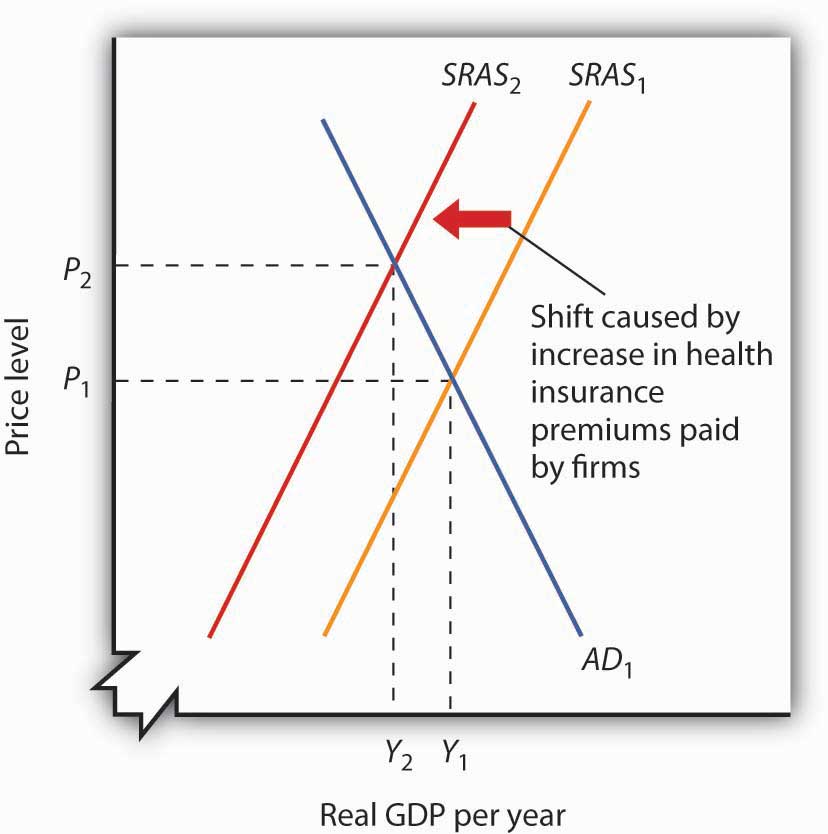

22.2 Aggregate Demand and Aggregate Supply: The Long Run and the Short Run – Principles of Economics

a. a short-run equilibrium but not a long-run equilibrium. b. a short-run equilibrium and long-run equilibrium. c. a long-run equilibrium but not a short-run equilibrium. d. neither a short-run equilibrium nor a

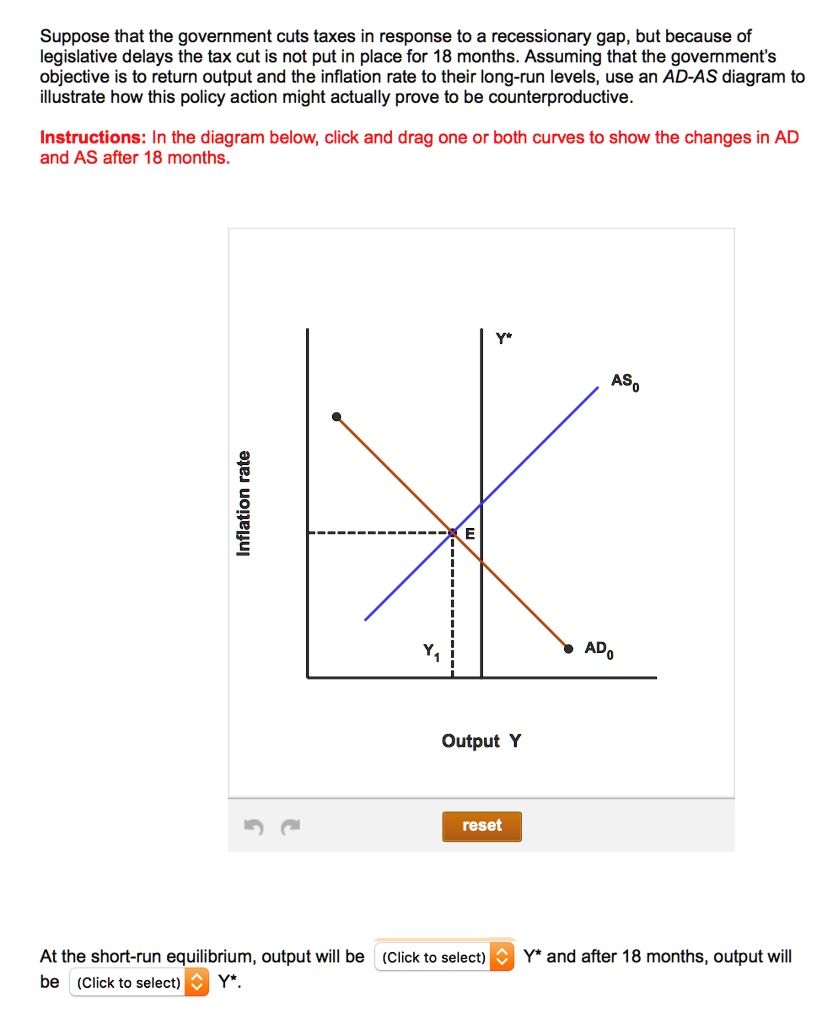

SOLVED: Suppose that the government cuts taxes in response to a recessionary gap, but because of legislative delays the tax cut is not put in place for 18 months. Assuming that the